Modi govt's mega banking reform: 10 Public Sector Banks to be merged into 4 entities

Punjab National Bank will become the second largest PSB in India with a total business of Rs 17.5 lakh crore post the merger while that of the Canara Bank and Syndicate Bank will be Rs 15.20 lakh crore.

New Delhi: The Narendra Modi government on Friday announced major banking reform measures by announcing the merger of 10 Public Sector Banks (PSBs) into four entities. The mergers have cut the total number of state-owned banks from 27 in 2017 to 12.

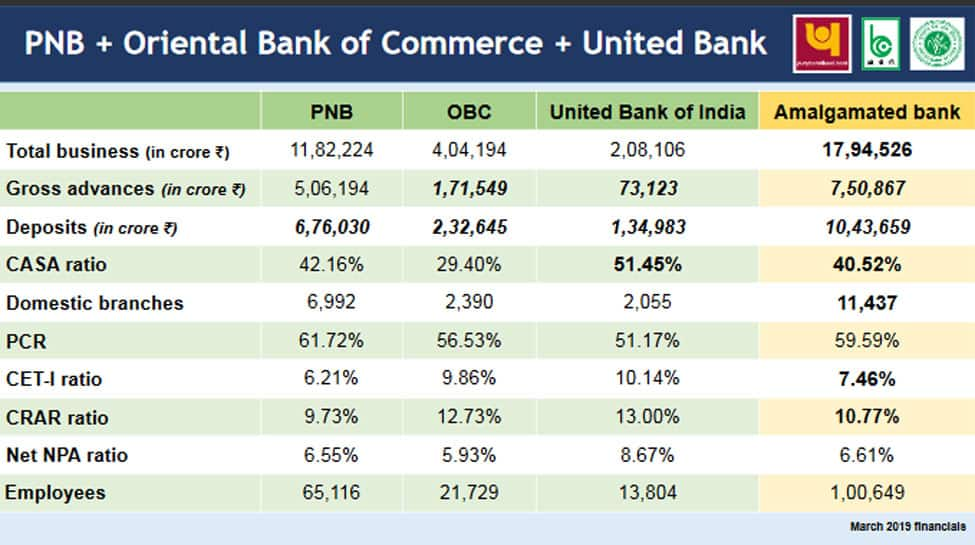

Addressing a press conference in the national capital, Finance Minister Nirmala Sitharaman said Punjb National Bank, Oriental Bank and United Bank will be merged to become the second largest PSU Bank in India.

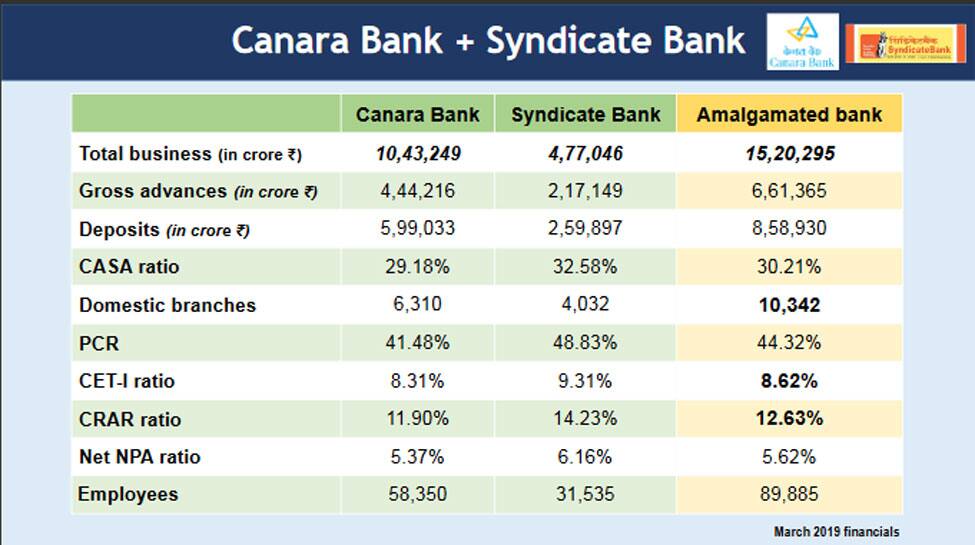

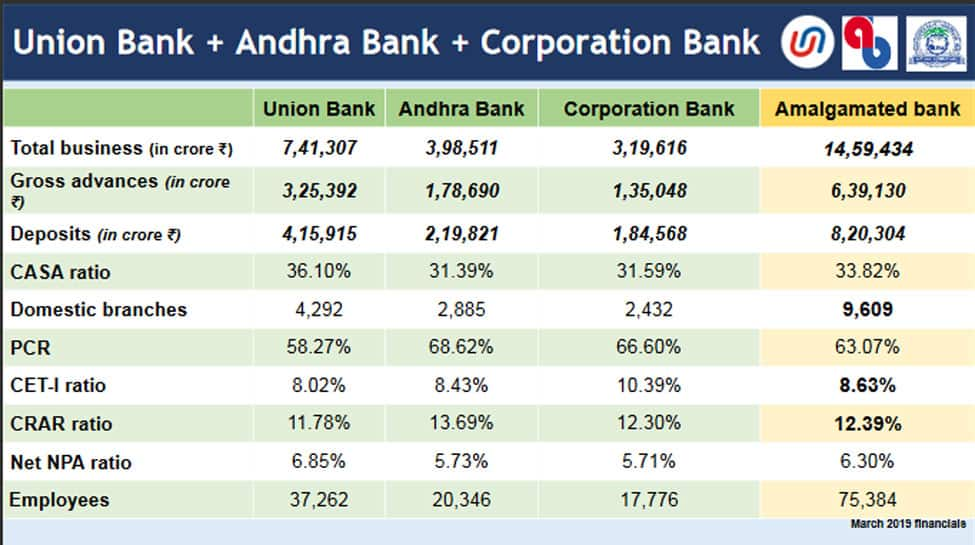

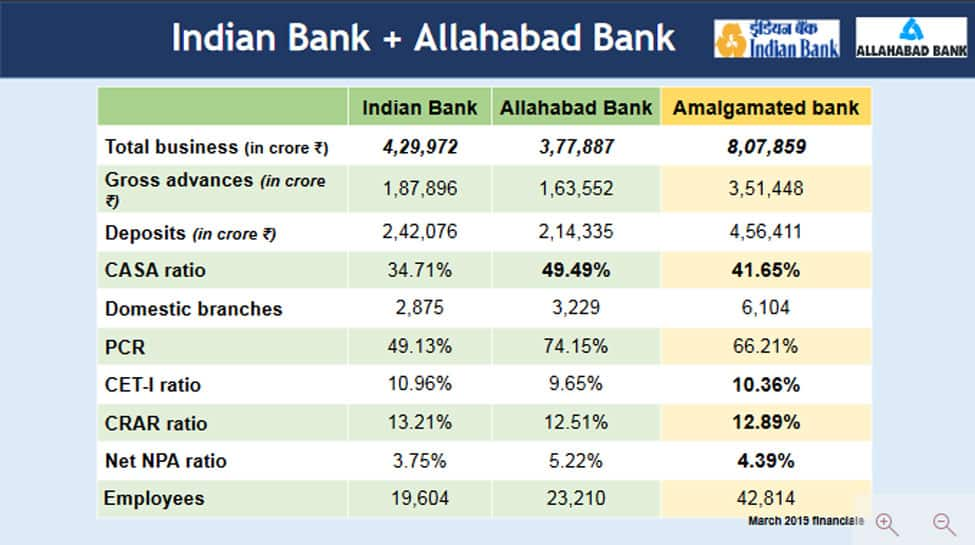

Canara Bank and Syndicate Bank will be merged into one entity to be 4th largest PSB, while Union Bank of India, Andhra Bank and Corporation Bank will be amalgamated into a single entity to be the 5th largest PSB; and Indian Bank and Allahabad Bank will become one entity to be the 7th largest PSB.

The Finance Minister further said that the Bank of India and Central Bank of India would remain independent. After the amalgamation, only 12 PSBs will be left in India from the 27 earlier.

Punjab National Bank will become the second largest PSB in India with a total business of Rs 17.5 lakh crore post the merger while that of the Canara Bank and Syndicate Bank will be Rs 15.20 lakh crore.

Consolidated Union, Andhra and Corporation Banks will have a total business of Rs 14.6 lakh crore while consolidated Indian and Allahabad Banks will have a total business of Rs 8.08 lakh crore.

Sitharaman said that consolidated Bank of Baroda, Vijaya Bank and Dena Bank merger have yielded wide ranging benefits for the banking and economic sector. It has seen robust CASA growth by 6.96 percent post the merger. Amalgamation of banks helped in strong retail loan growth.

Photo Gallery

Stay informed on all the latest news, real-time breaking news updates, and follow all the important headlines in india news and world News on Zee News.

)