NDA's Rafale deal cheaper than UPA's offer, says CAG: Read full text of report

The CAG report also states that the fly away price of the aircraft deal negotiated by both the governments is the same.

The Comptroller and Auditor General (CAG) in its report on Rafale deal said that the fighter aircraft under the Narendra Modi government is 2.86 per cent cheaper than the deal negotiated by the previous UPA government. The CAG report also states that the fly away price of the aircraft deal negotiated by both the governments is the same.

Read the full text here:

Acquisition of 36 Rafale Aircraft through IGA

1. Introduction

On 10 April 2015 an Indo-French Joint Statement was made in Paris between the Prime Minister of India and the President of French Republic to conclude an Inter-Governmental Agreement (IGA) for supply of 36 Rafale Aircraft in fly-away condition.

a) Following important points were agreed to in the joint statement:

The 36 Rafale jets would be acquired as quickly as possible.

An IGA would be signed for the supply of the aircraft on terms that would be better than conveyed by M/s Dassault Aviation as part of a

separate process underway. The delivery would be in time frame that would be compatible with the operational requirement of IAF aircraft along with weapon and associated systems would be delivered in the same configuration as had been tested and approved by IAF and with a longer maintenance responsibility by France. The better terms were related to ‘Price’, ‘Delivery’ and ‘Maintenance’ as decided by the DAC in its meetings of 28.08.2015 and 01.09.2015. The IGA was to be signed after negotiating the price and other terms and conditions. To negotiate with representative of French government along with M/s Dassault Aviation, Ministry of Defence constituted an Indian Negotiation Team (INT) on 12 May 2015 with the approval of Raksha Mantri.

b) The objectives of the negotiations were:

(a) To expedite the delivery of Rafale aircraft and weapons.

(b) To bring down the cost of procurement.

(c) To obtain offsets to support ‘Make in India’ campaign.

(d) To obtain better terms and conditions in respect of warranty and

product support.

c) Based on the recommendations of the INT, in August 2016, the Government approved the signing of Inter Government Agreement for procurement of 36 Rafale aircraft with weapons and associated systems at a cost of “U” million €. Ministry in September 2016 concluded following contracts with French vendors:

a. Aircraft Supply Protocol at total cost of “AV” million € with PDC72 as 2022

b. Weapon Supply Protocol at total cost of “BV” million € with same PDC

c. Offset contract with 50 per cent value of (a) and (b) above excluding the

PBL and STAAM costs

d) Audit examined the acquisition of 36 Rafale aircraft through IGA to assess if the objectives of Indo-French joint statement and the objectives set out

for INT by DAC were achieved.

Usually, in the IGAs for defence acquisition of Capital Assets, there are no comparable costs. However, keeping in view the Indo-French joint statement of April 2015, which stated that IGA would be signed for supply of the aircraft on terms that would be better (‘Price’, ‘Delivery’ and ‘Maintenance’) than the ones offered by M/s DA in 2007, a comparison has been made with the 2007 offer. This comparison of prices under 2007 and 2015 offers has posed its own difficulties because the package offered in 2007 included the price of License Production of 108 aircraft in India while the 2015 offer included only direct flyaway aircraft, which was compared costs of 18 flyaway aircraft.

Costs are fungible: Which part of the overall costs were applied to direct acquisition and which to ToT costs is often difficult to say, as happened, for example in the case of warranty of CKD and IM kits discussed earlier at Para 6(c)(ii) or in the case of Mermoz Test Benches (discussed later in Para 2(c). Difference in volumes may itself affect costs. Therefore, for comparing the prices for the current IGA there were multiple cost reference points in 2007 offer of M/s Dassault Aviation, as mentioned below:

i) Costs of 18 aircraft as flyaway aircraft

ii) Costs of 108 aircraft which were to be licensed produced in India by HAL and

which itself had following issues.

• M/s DA had refused to provide guarantee for aircraft to be produced by

HAL

• HAL had advised Ministry to multiply the man-hours quoted by M/s DA

by 2.7 for Indian conditions

iii) Costs of 126 aircraft as a whole with their warranty conditions, License

Production with ToT costs, maintenance etc

iv) Cost of basic aircraft and of the ‘fully loaded’ aircraft

In view of these complexities related to reduction in quantities, deletion of license production & ToT costs, option clause and bank guarantees in the 36 Rafale procurement, a review was undertaken to examine the Indian Negotiation Team’s process for alignment of costs in these two offers. The findings are discussed in subsequent paragraphs.

2. Audit Findings

2.1 Selection of Rafale for procurement through IGA Negotiations with M/s DA had reached a deadlock when the CNC realized that if the Indian man hours were applied to the cost of production quoted by M/s DA, the price of the aircraft would be substantially higher. Also the issue of warranty for the aircraft produced by M/s HAL was also not settled. In July 2014, M/s EADS gave an unsolicited offer of 20 per cent discount on the previous firm fixed 2007 offer on behalf of the Eurofighter typhoon Consortium. As per the letter, this offer was in view of further maturity in the Eurofighter typhoon program which had generated synergies. In this offer, EADS also offered to enhance the ToT process through a comprehensive training and support programme to be combined with creation of an Eurofighter Typhoon Industrial Park in India. Ministry did not accept this offer stating that it was an

unsolicited offer. Further, with the procurement of only 36 aircraft through an IGA, Audit also could not find any proposal with Ministry for filling of this wide gap in the operational preparedness of the IAF.

Ministry in response stated that M/s EADS unsolicited offer of 20 per cent discount had factual inaccuracies. The Ministry further stated that the 36 Rafale IGA procurement had been undertaken with the L1 bidder of the MMRCA case in consonance with the procurement process iterated in the DPP. It is seen that while there are no provisions of concluding an IGA with L-1 bidder in the DPP, however for INT and for Audit that reference point was necessary to determine better price, better delivery etc. as stipulated in the Joint Statement.

Ministry further informed that to fill up the gap Ministry had issued RFI for Single engine fighter aircraft through Strategic Partnership route. In addition Ministry stated that RFP for 83 Light Combat Aircraft has also been issued.

2.2 Assessment of achievement of the objective of reducing the cost of procurement

a. Unrealistic Price Benchmarking by INT

Before commencing negotiations, the Indian Negotiating Team estimated the bench mark price on a Firm & Fixed cost basis keeping in view of the expected discounts, market study, Rafale sale price from annual reports of M/s DA etc., as “R” million €.

This was about 57 per cent lower than the initial offer of the French Team and 46 per cent lower than the non -firm & fixed offer of “T” million € . Audit noted that as the INT was already aware of both the previous unrealistic benchmark pricing as well the commercial offer, they could have estimated the benchmark price more realistically. Audit also noted that in the process of procuring the MMRCA, this was the second time (first time in November 2011) that an unrealistically low benchmark prices were fixed.

b. Methodology for price comparison

The objective of the Indian Negotiation Team (INT) as derived from the term of the IGA and decision of DAC of “better prices” was to bring down the cost of acquisition of the 36 Rafale aircraft as compared to the cost of the previous procurement of 2007. The price offered by M/s DA in April 2008 against the RFP of 2007 (hereinafter referred to as 2007 price), was a market discovered price, and based on competitive bidding. The price offer of 2007 had two distinct packages – pricing for 18 Flyaway Aircraft Package and pricing for ToT package of 108 aircraft which were to be license

produced in India. The offer of 2015, on the other hand was only for 36 flyaway fighter aircraft. The acquisition and price bids of 2007 and 2015 were very different as the later included the price of ToT for license production of 108 aircraft in India which was 77.8 per cent of the total price bid of 2007. But since the pricing of ToT was a distinct package in 2007, comparison of the remaining package which pertained to 18 flyaway aircraft (one squadron) was somewhat possible if constrained by factors mentioned in Para 1, and therefore the INT compared these packages with their corresponding prices

in the 2015 price bid for 36 flyaway aircraft (two squadron). For comparing the prices of June 2007 bid with the bid of May 201573 first the scope of both the offers had to be brought at par. The INT had also to ensure that the 36 aircraft along with weapons and associated systems would be delivered in the same configuration as tested and approved by the IAF in 2007. The INT therefore aligned the quantities in the 2015 bid with that in the 2007 bid and

then the price of 2007 was brought to 2015 price level by applying the price escalation formula which used the industrial cost indices published by the French National Institute of Statistics and Economic Studies (INSEE). This was the Aligned Price i.e. the price of 36 flyaway aircraft in 2015 if the prices were the same as the bid of 2007.

Audit also used the same methodology and verified the price comparison made by the INT.

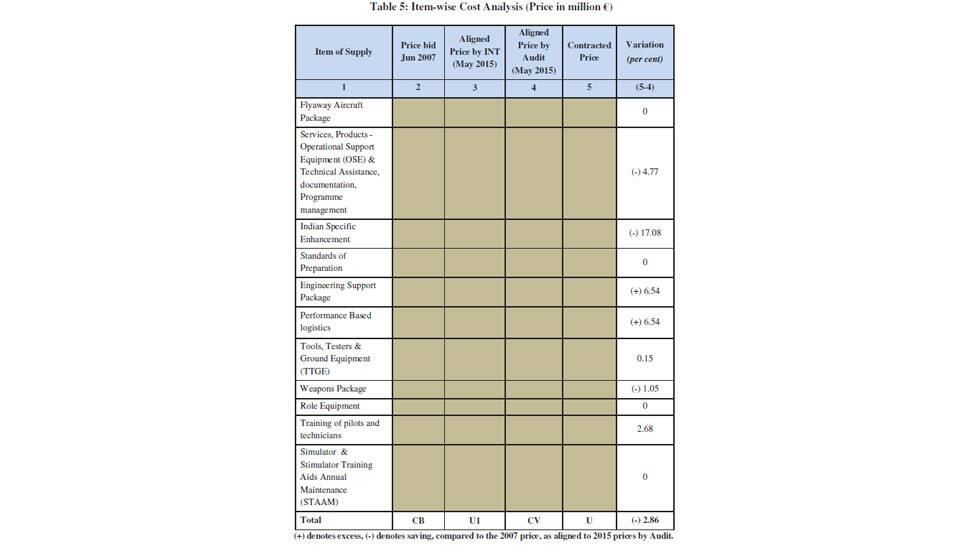

c. Comparative analysis of 2007 and 2015 price Bids

The Aligned Price worked out by INT was “U1” million € while the Aligned Price as assessed by Audit was “CV” million € which was about 1.23 per cent lower than the 73 Though the price offer was submitted in Jan 2016,the prices quoted by M/s DA as in May 2015. INT aligned costs. This was the price at which 2015 contract should have been signed if the prices of 2007 and 2015 were considered at par. But as against this the contract was signed in 2016 for “U” million € which was 2.86 per cent lower than Audit’s aligned price. The difference between the Aligned Price estimated by INT and Audit

could be attributed to inconsistent price variation factors adopted by INT, alignment of the quantities/scope of the two offers and the difficulties of alignment itself as stated earlier.

The contract consisted of six different packages - Flyaway Aircraft Package, Maintenance package, Indian Specific Enhancements, Weapon Package, Associated Services and Simulator Package. There were a total of 14 items under these six packages. Item wise analysis of prices showed that, the contracted price of seven items were higher than the aligned price, three were same and four were lower. Also the price of elements could not be compared because the structure/format of the M/s DA bid of 2007 and the offer of 2015 were different. This is discussed below:

(i) Indian Specific Enhancements

In the previous procurement of 2007 the M/s DA had quoted “XX” M€ as the Non Recurring Cost (NRC) for Design and Development of ISE. However, the vendor did not quote the price for the equipment and integration of the ISEs. The CNC had adopted “XX” M€ as the total price for ISE inclusive of these elements. In the price bid of 2016 M/s DA had quoted “IS” M€ for ISE. In addition it had quoted “IS1” M€ for ISE equipment and “IS2” M€ for integration. This was finally negotiated (2016) to “AX3” M€ as the total price for ISE which included “AX4” M€ for NRC and “IS2” M€ for integration. The price of equipment was also inclusive. Audit aligned the scope of the offer of 2007 and contract of 2016. The 2007 offer included Missiles ‘A1’ which was excluded by IAF in 2015 because it was being developed indigenously by Defence Research & Development Organisation (DRDO). In place of Missiles ‘A1’, IAF included Missile ‘A2’ for integration on the aircraft. The difference between integration of Missile ‘A1’ and Missile ‘A2’ which was “IS3” M€ had to be deducted from the ISE price of “XX” M€. This works out to “AX1” M€.

Therefore the aligned price by Audit was estimated to be “AX2” M€. As against this the contract was signed for “AX3” M€, a saving of 17.08 per cent.

During negotiation of 36 aircraft in 2015, in view of the huge cost and the reduced number of aircraft to be purchased, INT headed by the Deputy Chief of Air Staff (DCAS) proposed to reduce the number of Indian Specific Enhancements. But M/s DA stated that since its price was a total package Ministry would have to take up the matter with Govt. of France. In August 2016 before submission of the note to the approval of the CCS, DCAS (with the approval of CAS) intimated Ministry that ISE scope could be reduced by postponing six enhancements, which could be included if more Rafale aircraft were procured in future. However, this proposal was not accepted by MoD because that was tantamount to dilution of ASQRs which was not in consonance with the basic framework provided by the Joint statement of 10 April 2015 by the DAC that aircraft must have the same configuration.

Ministry in its response stated that reduction of ISEs scope was not considered after due deliberations as it was a temporary deferment only for cost reduction measure. Audit noted that four of these enhancements were stated not to be required in the technical and staff evaluations. The cost of these four enhancements items was “IS4” M€ constituting about 14 per cent of the ISE contracted cost. The Ministry has stated that “scaling down the requirement to limit cash outgo cannot be considered as saving”.

(ii) Engineering Support Package

In the RFP of 2007, IAF had projected the requirement of long term maintenance support for 18 flyaway aircraft to ensure the operational availability (more than 75 per cent) of the fleet. The RFP required the vendor to quote for both methods of maintenance viz., Engineering Support Package (ESP) and Performance Based Logistic (PBL)74 in 2007. One of the two options was to be chosen by Ministry during price negotiations. But M/s DA had quoted for a combination of ESP and PBL. The ESP or the spares support included three component of spares Aircraft, Engines and Avionics. The price comparison of the ESP of 2007 with that of 2015 is shown in the table below:-

Table 3: Analysis of ESP cost

M/s DA in its price bid of 2007 under the spares package, had quoted “AY5” million € for eight spare engines for 18 flyaway aircraft. In 2015 the vendor quoted “AY8” million € for 12 spare engines for 36 flyaway aircraft. Going by the rate offered in 2007 the 12 spares engines should have costed “AY7” million € in 2015. Thus the vendor charged about 6.54 per cent excess in this component of ESP.

The Ministry has stated that while comparing the price of ESP Audit had considered only the price of cost of engines and not engine spares. However, the Aligned price worked out by Audit (“AY7” M€) includes the cost of 12 engines (“AYY” M€) as well as engine spares (“AXY” M€). Further, the OEM of engine i.e. M/s Snecma had offered “ASN” M€ in 2007 for 8 engines and engine spares. For aligning the prices Audit had calculated the price of 12 engines in the same proportion as quoted by the OEM. Ministry further stated that in the 2015 offer, there has been addition in certain lines in the Spares list together with an increase in the quantities. However, this is not substantiated by the INT report. The INT report had stated that there was MRLS scope optimization due to which an amount of “AY20” million euros were reduced by the vendor without any change in the commitment of serviceability.

In the package, therefore, there is an excess of 6.54 per cent over the Audit aligned price.

(iii) Performance Based Logistics

Audit observed that in 2007 offer the vendor had quoted “AZ1” million € towards PBL which was for initial 5 years period covering maximum of “FH1” Flying Hours. This worked out to “AZ2” € per hour of flying. After applying the PV factor this works out to “AZ3” € per flying hours in 2015. In the 2015 contract the vendor had charged “AZ4” million € towards PBL for “FH2” flying hours, for five years. This works out to “AZ5” € per flying hour. Therefore the vendor had charged an excess of “AZ6” € per flying hours in 2015 as compared to his offer of 2007. The total excess price on account of PBL was about 6 per cent.

Ministry in response stated that the initial quote for MMRCA PBL was “AZ1” M (EC 2007) for 18 aircraft for five year for a total flying hours of “FH1”, which included PBL service for aircraft under warranty (“FH3” hours) and aircraft out of warranty (“FH4” hours). For a realistic comparison, this cost is required to be converted to “FH5” flying hours under warranty and “FH6” hours without warranty.

However, the price bid of 2007 did not envisage different pricing for PBL under warranty and PBL after the warranty period. Therefore, comparison of PBL prices in terms of warranty/non-warranty is not possible.

Ministry further stated that the price of PBL included an additional “AZ7” M€ towards Depot level maintenance (DLM) activities for equipment and thus the total price of PBL should be taken as “AZ8” M€. However, even in the 2007 offer, Depot level maintenance activities were included in the PBL costs. Even the documents annexed with reply state that DLM repairs were part of the PBL activities in the 2007 offer. In the package too, therefore, there is an excess of 6.54 per cent over the Audit aligned price.

(iv) Operational Support, Equipment, HUMS, Program Management and Services, Documentation and Technical Assistance.

In the bid of 2007, M/s DA had quoted the price of “ST1” M€ for the items Services, Technical Publications and Product including Technical Assistance, for 18 flyaway aircraft. However, in the offer of 2015, the price of the three items was quoted under different nomenclature/price heads. The correspondence between these elements of 2007 offer and 2016 contract was stated in the reply of the Ministry which is tabulated below:

Table-4: Mapping of components

The total Aligned price of these items works out to “ST9” M€, against which the contract the concluded for “ST10” M€, a savings of 4.77 per cent. Audit further noted that the price bid of 2007 did not define the item ‘Services’. Further, the price for Technical Publications was not contained in the bid. Ministry in its reply had stated that the item Services in the 2007 bid was the same as Program Management and Documentation as quoted in the 2015 offer, taken together. In the 2015 offer M/s DA had quoted “ST5” M€ towards ‘Documentation’ or Technical Publications as a separate/distinct item. Further under the price component ‘Associated Services’ the firm had quoted “ST4” M€ towards Program Management. The aligned price of services works out to “ST3” M€. Against this, Program Management and Documentation put together were contracted for “ST11” M€ in 2016, an excess of

“ST12” M€.

The items ‘Product’ and ‘Technical Assistance’ were together priced at “ST6” M€ in the 2007 offer. In the 2015 offer, these items were subsumed in Operation Support Equipment, HUMS and Technical Assistance, which were quoted as “ST8” M€. Against the aligned price of “ST7” M€, the Contract was signed at “ST8” M€, with a savings of “ST13” M€.

(v) Tool Tester and Ground Equipment (TT&GE)

In 2007 M/s DA had quoted “B1” million € for Tool Teste and Ground Equipment. This was for one Squadron. For two squadrons this works out to “2B1” million €. In the 2016 contract two additional item viz. Mermoz Test Benches (MPATE) were included which was not in the 18 flyaway aircraft package of 2007. In the offer of 2007 these Test Benches formed part of ToT package and which was to be installed at the Air Bases by HAL. But in the offer of 2015, since there was no ToT package these two Test Benches were included in the 36 fly away aircraft package. On the other hand, in lieu of the two Test Benches the vendor reduced the other items of TT&GE valuing “B2” million €. These items were to be positioned at two airbases for operational and

Intermediate maintenance by IAF. The alignment price works out to “B3” million €. The contracted price was “B4” million €. If the Aligned Price by Audit is taken, the contracted price is more than the aligned price of 2007 by 0.15 per cent.

(vi) Simulator Package

In response and as asked for in RFP, M/s DA’s offer stated they would consider

providing the required Simulators on a Build, Operate and Maintain (BOM) basis,

termed and conditions of which could be negotiated later. The vendor was to build the

infrastructure, install the Simulators and associated equipment; maintain them and

provide training to IAF personnel. The user charge/operating cost was to be paid to the

vendor periodically according to the usage rate agreement between the IAF and the

vendor on actual basis. However, in the bid M/s DA only gave the cost of Simulators.

In 2015, the vendor did not offer the Simulator package on BOM basis, instead the

vendor offered to sell the same set of Simulators and associated equipment at “SP1”

million € at outright purchase. This included “SP2” million € for installation and

commissioning which would have been borne by the vendor in the bid of 2007 since it

was on BOM basis. Further the vendor charged an additional “SP2” million € for

maintenance of the Simulators which would be effective after two years initial warranty

period and would last for next ten years. Operating cost was to be borne by IAF. Since

the operate (O) and Management (M) cost of BOM were not known, the price of the

Simulator Package in the offer of 2007 and the offer of 2015 were not comparable. The

INT has treated the maintenance charge of “SP2” million Euro, as being in lieu of the

Operations and Maintenance cost had BOM alternative. Since there was no BOM price

offer in 2007 either alignment with the 2007 price was not possible. On the cost of the

Simulators themselves Audit aligned price is “SP3” M€, which is the same as the

INT aligned price.

(vii) Training

In the 2007 offer of 126 MMRCA, the vendor was to provide basic training to 26 pilots

and 76 technicians of IAF at a cost of “TR1” million €. However, in 2015 offer, IAF

increased the scope of training to 27 pilots, 146 technicians and 2 Engineers. In addition

to this, the 2015 offer included an advanced training for 3 pilots, 1 engineer and 6

technicians at a cost of “TR2” million €. This was not available even during 126

MMRCA procurement. INT had aligned the price of basic training as “TR3” million €

which added with price of advanced training came to “TR4” million €. The contract

was signed for “TR5” million €. Audit alignment for training also came to the INT

alignment of “TR4” million €. Thus there was an excess of “TR6” million € which

is about 2.68 per cent in case of Training package.

Ministry stated that although scope of training had increased, the INT did not reckon

this enhancement. However, Ministry did not clarify the need for enhanced training

including the advanced training for “TR7” million € when the number of aircraft had

come down to 36 against the earlier 126.

(viii) Weapon Package

In RFP of 2007, IAF had projected the requirement of weapons for two squadrons. In

2015 also IAF had projected the requirement of weapons for two squadrons, but with

aligned quantities; and addition and deletion of certain weapons. After alignment of

scope the aligned price worked out to “WP1” M€ and the contract price was

“WP2” M€ a saving of 1.05 per cent.

Overall savings in the Weapons package can be attributed to alignment in scope of

various items of the weapons package.

(ix) Basic Aircraft package

The Ministry in its response (January 2019) has accepted that the Aligned price worked

out by INT and Audit in case of basic aircraft were the same but argued that the

negotiated/contracted price of 36 flyaway aircraft was 9 per cent lesser than the price

offered for the aircraft in 2007. This was because the L1 subcommittee of 126

MMRCA had estimated the average cost of each flyaway aircraft till its median delivery

as “DL1”€. Ministry has stated that “had the bid been finalized and the contract signed

in the MMRCA case in 2011, this would have been the fixed price of the aircraft”.

Against this, each aircraft was contracted in 2016 (under 36 Rafale contract) for “DL2”

M€ which was a saving of 9 per cent.

The bid price offered by M/s DA in 2007 for the flyaway aircraft was “DL3” M€. Para

42(a) of the RFP required the Vendors to provide firm and fixed prices. Further Para

14(g) of Part I of RFP specified that for product support an indices based formula was

to be provided valid for 40 years with an annual cap. L1 subcommittee in its report

stated (Para 2.1) that M/s DA had offered costs with a base price of June 2007 subject

to escalation. The L1 subcommittee used the actual values available till June/July 2011

and used provisional values till September/October 2011. Beyond this, till the mid

delivery period the committee used an annualized year on year escalation rate based on

the historical data. This was done as the actual escalation factors were not available

with the L1 subcommittee for the period 2012 to the mid delivery period. In 2015, the

INT and Audit had the actual escalation factors and the 2007 offer of “DL3” M€ was

escalated to “DL2” M€. Therefore, there is no difference between the bid of 2007 as

escalated by INT with actual escalation factors, and the negotiated cost of the 2015

offer, for the same aircraft.

Conclusion

Overall, it may be seen that as against the Aligned Price as estimated by Audit of

“CV” million € the contract was concluded for “U” million € i.e. 2.86 per cent lower

than the Audit Aligned Price. The same is summed up in the table in the below.

Table 5: Item-wise Cost Analysis (Price in million €)

2.3 Other issues In the offer of 2007 M/s DA had provided the financial and

Performance Guarantees, the cost of which was embedded in the offer because the RFP

had required the Vendor to factor these costs in the Price Bid. But in the offer of 2015

Report No. 3 of 2019 (Performance Audit) there were no such guarantees as it was an IGA. Therefore, these savings to the vendor

would have to be factored in as explained below:

The vendor was to provide Bank Guarantee against the 15 per cent advance

payment made by Ministry to the vendor which would be outstanding for

three years till the deliveries of equivalent amount are made by the vendor.

The Bank charges which the vendor would have to pay to hold this guarantee

works out to “AAB1” million € (@ the Bank rate of 1.25 per cent per annum

as claimed by the vendor)75 and 0.34 per cent as checked independently by

the INT.

The offer of 2007 included Performance Guarantee and Warranty valuing

10 per cent of the total value of the contract which was to be held till the

completion of deliveries i.e. 5.5 year. The Bank charges for this works out to

“AAB2” million €.

Therefore, the total saving of “AAB3” million € accruing to the vendor by not having

to pay these Bank Charges should have been passed on to Ministry. Ministry has agreed

to the Audit calculations on Bank Guarantees but contended that this was a saving to

the Ministry because the Bank guarantee charges were not to be paid. However, Audit

noted that this was actually a saving for M/s DA when compared to its previous offer

of 2007.

2.4 Assessment of terms and condition in acquisition achieved though IGA

Fundamentally, in an acquisition through Inter Government Agreement (IGA) the

government identifies a need for a military equipment or service and then chooses to

acquire it from the government of another country, instead of procuring directly from

the vendor. The foreign government may offer the equipment from its own inventory

or procure it from the vendor through its own procedure and then transfer it to the

buying government

One of the major benefit of IGA is that the selling government procures the items from

their vendors on behalf of the buying government, using the same procedure, terms and

conditions which it uses for its own procurements. As a result, the buying government

receives the same benefits and protections as the vendor gives to its own government.

The cost of such procurements are considered to be lower because the equipment is

already in use by the selling government and much of the cost of R&D and other fixed

costs would have been recovered by the vendor. It is pertinent to mention that

75 During negotiations with the vendor to reduce the price, Ministry had found out from a French bank

(through the Indian Embassy) that the rate was 0.34 per cent. If this is taken the impact of bank

charges works out to be about α million €.

Report No. 3 of 2019 (Performance Audit)

acquisition through IGA had been made from UK, USA and Russia, it was the first time

that IGA was signed with the French government. In case of IGA for 36 Rafale, the

offer of M/s DA in 2007 had included 15 per cent Bank Guarantee against advance

payments, 5 per cent each for Performance Guarantee and Warranty. A Bank Guarantee

gets directly and automatically invoked in case of breach of contract by the seller. In

the 2015 offer the French vendor did not furnish any Financial and Performance Bank

Guarantees. Since about 60 per cent of advance payments were to be made to the French

vendors, Ministry of Law and Justice advised that Government/Sovereign guarantee

should be requested in view of the value of the proposed procurement. However, the

Government of France and Vendor neither agreed to furnish the Bank guarantees nor

Government/Sovereign guarantee. Instead it provided a ‘Letter of Comfort’ signed by

the French Prime Minister in lieu of the Bank Guarantee.

The issue on sovereign guarantee and letter of comfort was finally submitted to the CCS

in September 2016 for consideration which approved the acceptance of Letter of

Comfort from French Prime Minister “ along with other associated

guarantees/assurances provided in the IGA in lieu of Bank Guarantee subject to

payments through an escrow account or any other safeguards which the Ministry was

to work out in consultation with the French Government with the assurance by the

French Government that they shall provide effective oversight on the utilization of

payments released to the French Industrial suppliers”. The French government did not

agree to an escrow account as it felt that “the guarantees already provided by the

Government of France were far reaching and unprecedented”. The finally approved

Article 5 of IGA by the DAC, provided that the advance payments were to be made

directly to the Bank accounts of French vendor that were opened in French Government

controlled Bank, over which the French Party was to exercise control and monitoring

for effective implementation of the IGA and the supply protocols.

In case of any breach of agreement Indian party (Ministry) would have to first settle it

through Arbitration directly with the French vendors. If the Arbitration award were in

favor of Indian party and the French vendor fails to honor the award (make the

payment’s claim), Indian party should exhaust all available legal remedies. Only then

the French Government would make these payments on behalf of the vendors.

Ministry in its reply stated that the IGA has been signed between two Strategic Partners

who are Sovereign nations with long standing Strategic relationship. Further based on

the advice of the Ministry of Law and Justice, responsibility of the French Government

and M/s DA was made “Joint and Several” in the IGA. This would make the French

Government equally responsible to fulfil its obligations.

Report No. 3 of 2019 (Performance Audit)

140

2.5 Assessment of achievement of faster deliveries

One of objectives of the INT, which was derived from the Indo-French Joint Statement,

was to expedite the delivery of the aircraft and weapons as compared to the delivery

period offered by M/s DA in 2007.

According to the original delivery schedule offered by M/s DA in 2007, first 18 flyaway

aircraft were to be delivered between 37 months to 50 months of signing of the contract.

Next 18 aircraft which were to be licence produced in HAL, were to be delivered from

49th to 72nd months of signing of the contract. During negotiations the Indian

Negotiation Team (INT) conveyed to the French side that it expected the delivery of

first batch of 18 Rafale aircraft in 24 months after the signing of the IGA; and next

batch of 18 aircraft in 36 months after the signing of IGA. However, the delivery

schedule finally offered by the French side was 18 aircraft by 36 to 53 months after the

signing of IGA, and the remaining 18 aircraft to be delivered by 67 months of signing

of IGA. This was better than the delivery schedule of 2007 by 05 months.

However, Audit noted that as against the delivery period of 72 months in the earlier

offer the contracted delivery schedule for 36 Rafale aircraft was actually 71 months.

The ISE on the first aircraft would be completed by T0 + 63 months and integration on

the next 35 aircraft would be completed in 8 months. Thus, there was an improvement

of one month in the delivery schedule of the 2016 contract.

Further, Audit noted that INT had apprehensions about the achievement of even this

delivery schedule, because at the time of signing of the contract M/s DA had an order

backlog of 83 aircraft. Considering its production rate of 11 aircraft a year, clearing this

backlog itself would take more than seven years. Ministry in its response stated that the

Project was currently on schedule and the progress was being closely monitored by the

resident Project Management Team and also through the Inter-Governmental Bilateral

High Level Group.

2.6 Commercial advantage of Non-Firm and Fixed Price bids

Ministry in its response (January 2019) had repeatedly stated that initially in the RFP

of 2007, M/s DA was required to submit the price offer on Firm and Fixed (F&F)

basis. As seen earlier, this was interpreted by the CNC/L-1 subcommittee as

quoted price escalated as per the formula to the mid delivery period. In 2015 also,

M/s DA was asked firm and fixed price. This time it offered a cost of “AX13” million

€. The INT was informed by the French side that it had arrived at the price of “AX13”

million euros by applying indices based escalation formula from base of June 2007 till

May 2015, and thereafter escalating till the mean delivery period at the annual rate of

3.9 per cent. Since the F&F cost of “AX13” million euros was too high, Ministry invited

the bid at non-firm and fixed prices. This time M/s DA offered a price of “T” million

Report No. 3 of 2019 (Performance Audit)

141

euros which was finally negotiated to “U” million euros. The escalation on the price

was to be based on French rates of inflation, subject to a cap of 3.5 per cent per annum.

Ministry has stated that it has obtained a commercial advantage of between “AX14”

million euros (at the escalation cap of 3.5 per cent) to “AX15” million Euros as the

recent inflation rate in France has been 1.22 per cent.

Any savings which accrues would be due to the difference between the escalation cap

and actual escalation rates, between the years 2016 and 2021. These would have also

been available in the 2007 commercial offer depending upon escalation rates, but after

the mid delivery period, as calculated by the CNC/L-1 subcommittee in 2011-12.

The fact that Non F&F bids may be more advantageous than F&F price bids has been

discussed by Audit in its report in Chapter 6 of Volume I.

Stay informed on all the latest news, real-time breaking news updates, and follow all the important headlines in india news and world News on Zee News.