Is your PAN card linked with Aadhaar card? Follow these three simple steps to find out

Here is what you will have to do.

- Your PAN must be linked with your Aadhaar for ITR Filing.

- Quoting of Aadhaar is mandatory for filing income tax returns.

- PAN holder, eligible to obtain Aadhaar, must intimate his Aadhaar number to the tax authorities.

New Delhi: With Income Tax Filing deadline nearing in some time, you must make sure that your PAN card is linked with your Aadhaar card.

Tax payers will be filing the Income Tax Return (ITR) for the FY 2019-20 (AY 2020-21). The government has made quoting of Aadhaar mandatory for filing income tax returns (ITRs) as well as obtaining a new PAN.

As per Section 139 AA (2) of the Income Tax Act, every person having PAN and eligible to obtain Aadhaar, must intimate his Aadhaar number to the tax authorities.

If you have already linked your Aadhar number with your PAN, you can check the status online. Here is what you will have to do:

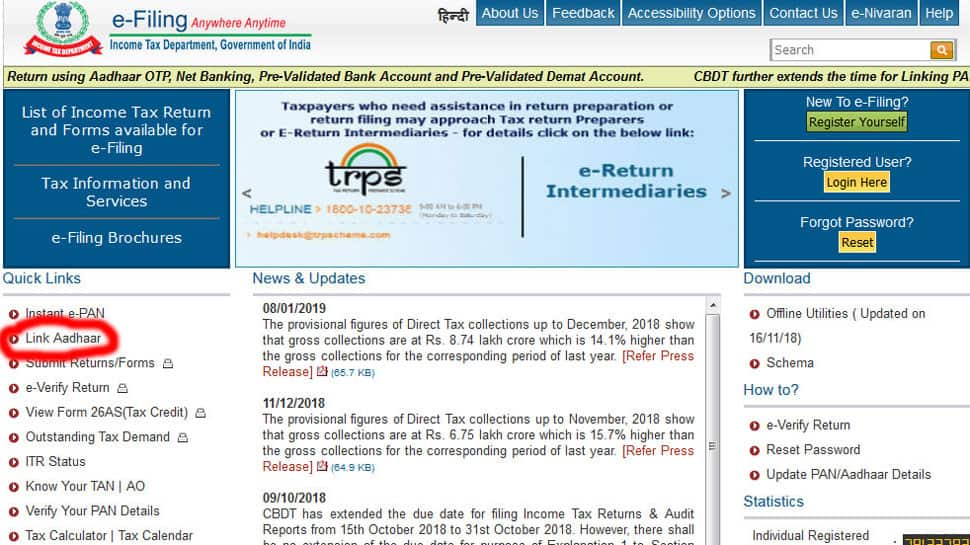

Go to the income tax website:

https://www.incometaxindiaefiling.gov.in/home

- On the extreme left hand side, you will see "Link Aadhaar" option. Select that.

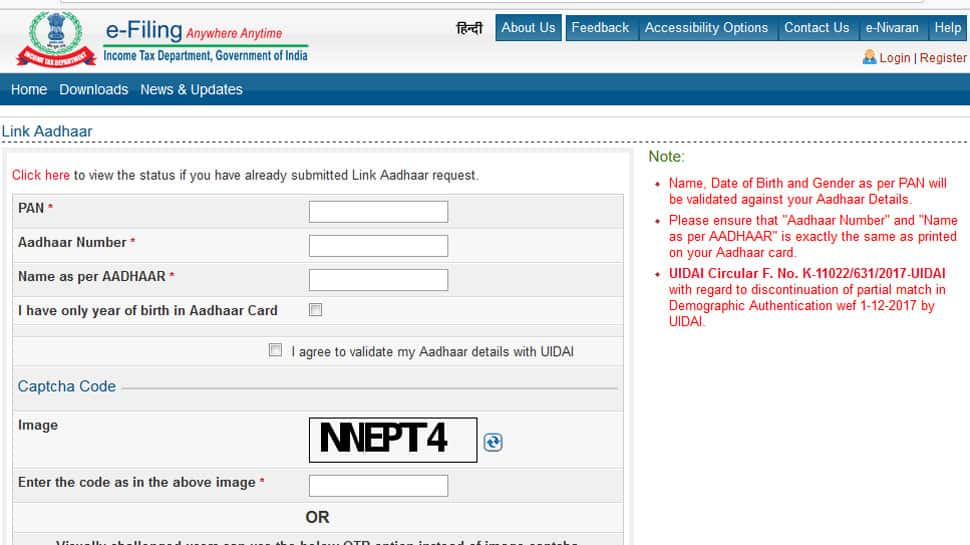

- Just on the top of the PAN box, you have an option to click and view the status if you have already submitted Link Aadhaar Request

Select that Option

You will be given two choices

1. Fill in Your PAN details

2. Fill in Your Aadhaar details

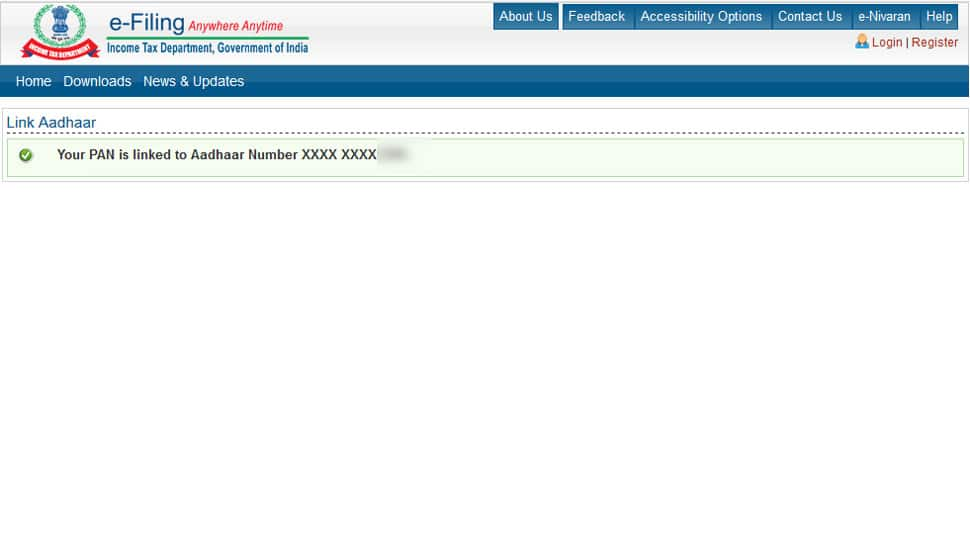

If your Aadhaar and PAN are linked, you will get a confirmation message

E-filing of the ITR is mandatory for all individuals except those earning less than Rs 5 lakh per annum and those who are above 80 years of age. Hence, if you have not yet linked your PAN with Aadhaar, you must do it on priority basis.

What are the important deadlines on taxation?

Government had in May this year announced that the due date of all income-tax return for FY 2019-20 will be extended from 31st July, 2020 and 31st October, 2020 to 30th November, 2020 and Tax audit from 30th September, 2020 to 31st October, 2020.

Stay informed on all the latest news, real-time breaking news updates, and follow all the important headlines in india news and world News on Zee News.

)