THIS Post Office Scheme offers Rs 35 lakh on maturity; check monthly investment, return calculator, policy terms

)

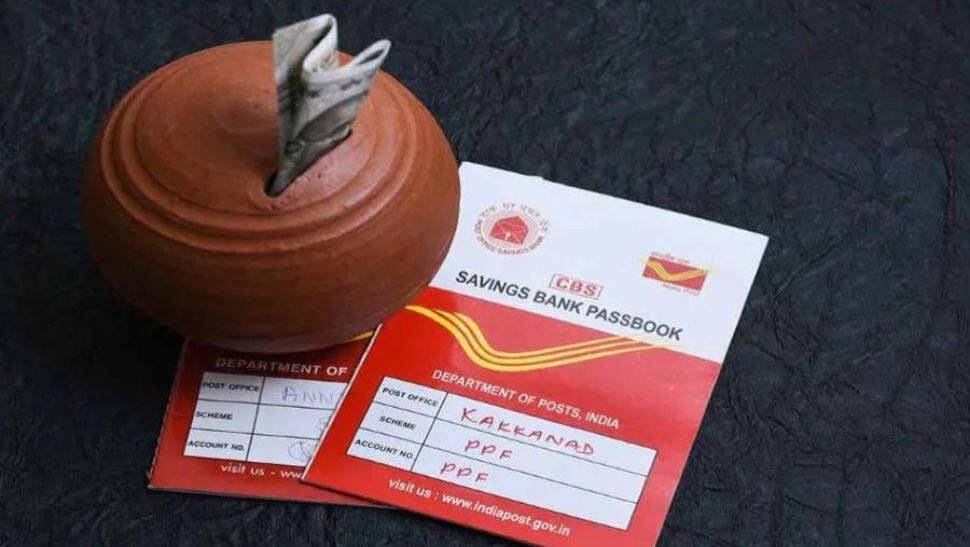

The India Post is an important means for residents in rural India to save money, as the government-backed entity offers many initiatives to these citizens. To satisfy the requirements of the people in the country's undeveloped areas, the India Post has put in place many risk-free savings plans that offer good returns, thereby safeguarding their future. The post office has launched several plans under the Rural Postal Life Insurance Schemes Program, the most popular of which is the Gram Suraksha Yojna. Go through the slides to know more about this policy of India Post Office.

-The minimum and maximum entrance ages are set at 19 and 55 years old, respectively.

- Minimum sum assured is Rs 10,000; maximum sum assured is Rs 10 lakh.

- After four years, the loan facility is available. - -If the scheme is abandoned before 5 years, it is not eligible for a bonus.

- Can be changed into an Endowment Assurance Policy up to the age of 59, provided the date of conversion does not come within one year after the date of premium cessation or maturity.

- The premium paying age can be 55, 58, or 60 years old.

- If the policy is surrendered, a proportionate bonus on the lower sum assured is provided.

- The most recently disclosed bonus is Rs 60 per Rs 1000 cash assured per year.

Rural Postal Life Insurance (RPLI) was created in 1995 for rural Indians. According to the India Post website, "the primary goal of the scheme is to give insurance cover to the rural public in general, to help poorer sections and women workers in rural regions in particular, and to increase insurance knowledge among the rural people."

A policyholder can earn up to Rs 35 lakh in returns by contributing just Rs 50 each month under the Gram Suraksha Yojana. If the person invests Rs 1,515 in the policy each month, which is around Rs 50 per day, the person will receive a return of Rs 34.60 lakh after the policy matures. An investor will receive a maturity benefit of Rs 31,60,000 for a 55-year term, Rs 33,40,000 for a 58-year term, and Rs 34.60 lakh for a 60-year term.