Post Office Customers, Alert: India Post Payments Bank revises cash withdrawal, deposit charges

IPBB issued a notification dated November 30, 2021, to announce the revision of cash deposit and withdrawal charges.

- The new charges will be applicable from January 1, 2022.

- IBBP said that the above-mentioned charges are exclusive of goods and service tax (GST) or applicable CESS.

- ICICI Bank also announced that it is going to revise the Service charge on the ICICI Bank Savings Accounts.

New Delhi: Following in the footsteps of other public and private banks, the India Post Payments Bank (IPBB) has announced a revision in major banking charges. IPPB has revised the charges on cash withdrawals and deposits at physical branches.

The new charges will be applicable from January 1, 2022. IPBB, which is a division of Indian Post, issued a notification dated November 30, 2021, to announce the revision of cash deposit and withdrawal charges.

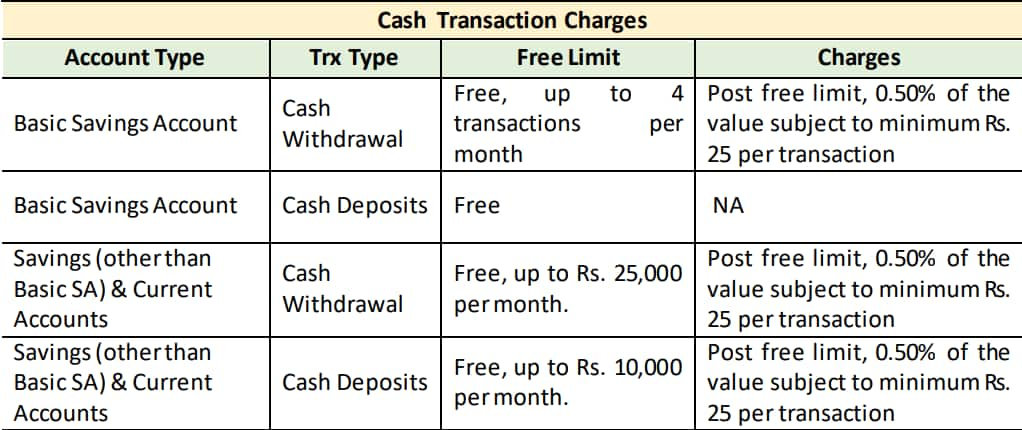

“This is to inform all the concerned that charges of on Cash Deposit & Cash Withdrawal transactions as mentioned below will be effective from 01st January, 2022,” IPBB said in its notification.

According to the notification, IPPB Basic Savings Account customers will now have to pay “0.50% of the value subject to minimum Rs 25 per transaction” after free four cash withdrawal transactions.

For cash deposits, Basic Savings Account customers don’t have to pay a single penny, meaning that the service will be free from January 1, 2022.

However, other savings account customers will now have to pay “0.50% of the value subject to minimum Rs 25 per transaction” after free withdrawals up to Rs 25,000 per month.

Similarly, on cash deposits, savings account customers should get ready to pay “0.50% of the value subject to minimum Rs 25 per transaction” after free deposits up to Rs 10,000 per month.

Moreover, IBBP said that the above-mentioned charges are exclusive of goods and service tax (GST) or applicable CESS. Also Read: Sensex tanks 764 points, Nifty sinks below 17,200 as Omicron enters India

Earlier in the day, ICICI Bank also announced that it is going to revise the Service charge on the ICICI Bank Savings Accounts with effect from 01 January 2022. The bank has also announced revision in ATM Transaction Charges - Domestic Savings Account holders from January 01. Also Read: Samsung Galaxy S21 FE price revealed! Here’s how much it may cost

Stay informed on all the latest news, real-time breaking news updates, and follow all the important headlines in india news and world News on Zee News.

)