FM Sitharaman announces merger of PNB, OBC, United Bank to make India's 2nd largest PSB

Her press conference comes just a little ahead of the release of India's latest Gross Domestic Product (GDP) growth numbers.

Trending Photos

)

New Delhi: Finance Minister Nirmala Sitharaman is addressing a press conference in the national capital. Her press conference comes just a little ahead of the release of India's latest Gross Domestic Product (GDP) growth numbers.

Here are the updates from FM's press conference

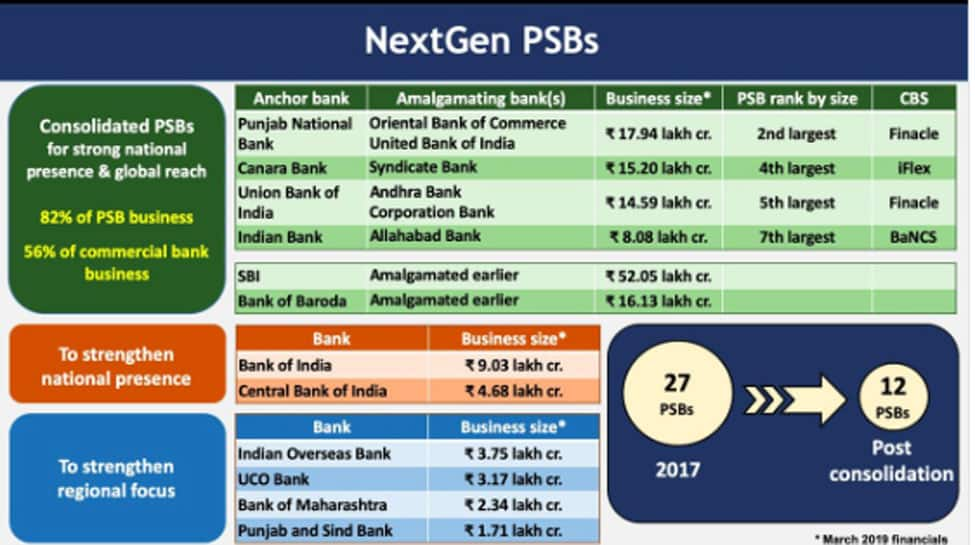

In place of fragmented lending capacity with 27 PSBs in 2017, now 12 PSBs post consolidation, tweeted Rajeev kumar

In place of fragmented lending capacity with 27 PSBs in 2017, now 12 #PSBs post consolidation. बड़े बैंक अब अपना लक्ष्य रखेंगे global मार्केट पर, मँझले बैंक बनेंगे राष्ट्रीय स्तर के और कुछ बैंक स्थानीय नेतृत्व करेंगे। @PMOIndia @FinMinIndia @PIB_India #PSBsFor5TrillionEconomy pic.twitter.com/Z4dcyZOG5f

— Rajeev kumar (@rajeevkumr) August 30, 2019

No retrenchment has taken place post merger of Bank of Baroda, Dena Bank and Vijaya Bank; staff has been redeployed and best practices in each bank have been replicated in others.

Consolidated Indian and Allahabad Banks to be 7th largest PSB with Rs 8.08 lakh crore business. Strong scale benefits to both with business doubling. High CASA & lending capacity combined in consolidated bank.

Gains visible from PSB Reforms: 14 PSBs in profit in Q1FY20, GNPAs down by Rs 1.06 lakh crore, record recovery & highest PCR in 7 years. Stage set for NextGen PSBs.

Consolidated Union+Andhra+Corporation Banks to be 5th largest PSB with Rs 14.6 lakh crore business and 4th largest branch network in India. Strong scale benefits to all 3 with biz becoming 2 to 4½ times that of individual bank.

PNB, Oriental Bank and United Bank will be merged to become the second largest PSU Bank in India with business of Rs 17.95 lakh crore (1.5 times that of PNB).

Total Employee strength: PNB – 65,116, OBC – 21,729, United bank – 13,804

Canara Bank + Syndicate Bank: 4th largest PSB with business of Rs 15.20 lakh crore ( 1.5 times of Canara bank) 3rd largest branch network in india with 10,342 branches.

#NextGenBanks

Unlocking potential through consolidation, big banks with enhanced capacity to increase credit and bigger risk appetite, with national presence and global reach pic.twitter.com/SY6iE8tt9p — PIB India (@PIB_India) August 30, 2019

BoB + Vijaya Bank + Dena Bank merger have yielded wide ranging benefits for the banking and economic sector. It has seen robust CASA growth by 6.96 percent post the merger. Amalgamation of banks helped in strong retail loan growth.

Specialised agencies have been set up who are monitoring every loan which is over Rs 250 crores.

4 NBFCs have found their liquidity solutions through PSBs since last friday with more in pipeline. Indian economy is $2.6 trillion of which $1.9 trillion is credit

Government is focused on making economy a 5 trillion dollar economy

Past announcements made is focused on bank rates, product launches, improving sentiments

We need to lay strong foundation for economic sector and banking sector

The recent steps taken has helped in better loan recovery

Gross NPAs has come down. Loan recovery in FY19 stood at 1,21,076 crore while the NPAs were brought down to 7.90 lakh crore, from 8.86 lakh crore in March 2018

PSB reforms is now showing positive results as loan reciver has increased while Gross NPAs have gone down significantly

Stay informed on all the latest news, real-time breaking news updates, and follow all the important headlines in india news and world News on Zee News.

Live Tv

)

)

)

)

)

)

)

)

)

)