PPF Calculator: Rs 5000 monthly investment can return over Rs 1.05 crore. Details here

PPF Return Calculator: The government is offering a return of 7.1 per cent on PPF. The PPF interest rate is subject to change every quarter as per the government's directive.

- The government is offering a return of 7.1 per cent on PPF.

- The PPF interest rate is subject to change every quarter as per the government's directive.

- The PPF also offers income tax exemptions under Section 80C of the Income Tax Act 1961.

Trending Photos

) PPF Calculator: Suppose you start investing Rs 5000 per month in PPF at the age of 25 years, then the yearly amount would be Rs 60,000.

PPF Calculator: Suppose you start investing Rs 5000 per month in PPF at the age of 25 years, then the yearly amount would be Rs 60,000. PPF Interest Calculator: When it comes to investment, many people want a better return and risk-free instrument to bet on. While there are many such instruments including fixed deposits, one such scheme is Public Provident Fund (PPF). PPF is a government-backed saving scheme that offers assured returns to its investors upon maturity. The PPF is also a popular option as it also offers income tax exemptions under Section 80C of the Income Tax Act 1961. The one thing to keep in mind while investing in PPF is that it comes with a maximum investment cap of Rs 1.5 lakh per year and the maximum tenure is 15 years. Thus, one has to renew it after every 15 years.

The government is offering a return of 7.1 per cent on PPF. The PPF interest rate is subject to change every quarter as per the government's directive. However, given the past trends, it can be expected that the rates will remain around this or a bit higher in the coming years.

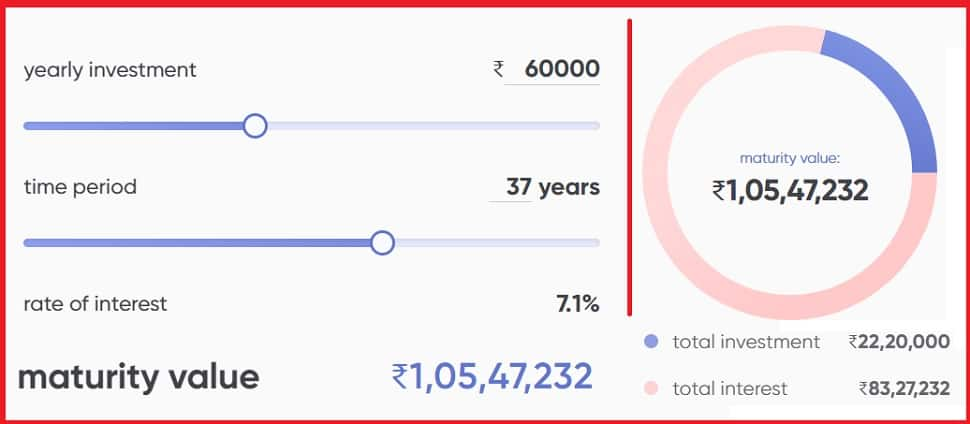

PPF Return Calculator

Suppose you start investing Rs 5000 per month in PPF at the age of 25 years, then the yearly amount would be Rs 60,000. At the given interest rate of 7.1 per cent, you will earn Rs 7,27,284 in 15 years and the total investment would be Rs 9,00,000. The maturity amount would be Rs 16,27,284.

However, if you continue this investment of Rs 5,000 per month for 37 years, the same will yield a return of Rs 83,27,232 while the total investment would be Rs 22,20,000. The maturity amount would be Rs 1,05,47,232.

As explained above, since the PPF's maximum tenure is 15 years, if you want to continue it for 37 years, you will have to fill out the renewal form -Form 16-H at the end of the 15th, 20th, 25th, 30th and 35th years from the PPF account opening date.

Stay informed on all the latest news, real-time breaking news updates, and follow all the important headlines in india news and world News on Zee News.

Live Tv

)

)

)

)

)

)

)

)

)

)