Union Budget 2023: Insurance Policies Where Premium is Above Rs 5 Lakh no More Tax Exempt

Now there is no tax exemption on insurance policies whose premium is over Rs 5 lakh.

- No more tax exemption on insurance whose premiums are over Rs 5 lakh.

- Union Budget 2023-24 is presented today by FM Nirmala Sitharaman.

- Income Tax slabs also changed in the provisions of Union Budget 2023.

Trending Photos

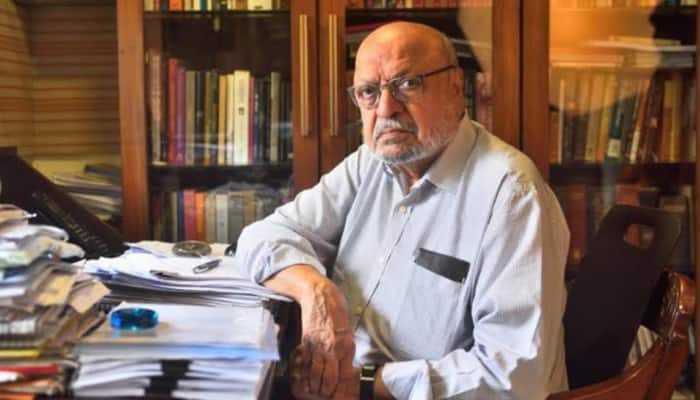

) File Photo

File Photo New Delhi: Insurance policies where the premium is over Rs 5 lakh will no longer be tax-exempt, as per the provisions in the Union Budget 2023-24. Kapil Mehta, Co-founder, SecureNow Insurance Broker said the income from traditional insurance where the premium is over Rs 5 lakh will not be tax exempt. While this will dampen the interest of individuals to buy high-value traditional insurance, it will increase the focus on term plans and pure risk covers which is good.

Bardia said this is negative for insurance -- as it will impact savings products which are usually high-value and margin products (though not protection). However, smaller policies remain unaffected. Overall a negative for insurance companies as it will impact the high-value premium policies -- thus impacting overall industry GWP growth. (Also Read: Union Budget 2023 Cheaper, Dearer Items: Here's a List of Items Supposed to get Cheaper and Price of THESE Commodities are Anticipated to Increase)

A similar provision was already introduced for ULIPs in 2021 wherein the aggregate premium was restricted to Rs 2.5 lakh in a year for tax-exempt proceeds", said Bardia. Mehta said improvements in ease of doing business specifically, the changes pertaining to simplification of the KYC process, one-stop solution for identity and address updating, common business identifier, unified filing, and entity Digi locker will make placement of insurances easier. Claims payment would also be facilitated.

Changes in personal income tax will increase personal disposable income. This will result in individuals' ability to buy better, higher-value insurance to manage their risk, Mehta said.

Stay informed on all the latest news, real-time breaking news updates, and follow all the important headlines in india news and world News on Zee News.

Advertisement

Live Tv

Advertisement

)

)

)

)

)

)

)

)

)

)